The most consequential Davos ever

+ the great SaaS Meltdown

Crazy demographic stat of the week: there were fewer births in China in 2025 than in 1776, the year the United States declared independence.

Millennials / Gen Xs raised in the West in the past few decades are always tempted to stick to the nothing ever happens view (trading at 4c on the dollar), with rare concessions that yes, something happens sometimes, but the overall political-moral-technical order of the world is isomorphically preserved. If the past few years weren’t enough to doubt it, Davos 2026 is a generational call that the gates are wide open, the centre cannot hold, the Overton window not only has shifted, but it’s letting through a storm.

What sovereignty (monetary, civic, biological, technological) will mean, in what entities it will reside and how it will be exercised, are the fundamental questions of the next decades. We are hosting an exclusive research seminar to answer this in London in March. Get in touch to join us.

If you’re still of the nothing ever happens gang, drop the magical ball and let some Davos 2026 change your mind.

Most Consequential Speeches at Davos 2026

1. Mark Carney

Canada’s prime minister delivered what was described as “the most consequential speech on global affairs” declaring the world is “in the midst of a rupture, not a transition” and that the old world order “is not coming back.”

2. Friedrich Merz

“We must reduce bureaucracy substantially in Europe. The single market was once created to form the most competitive economic area in the world, but instead, we have become the world champion of overregulation.”

Absolutely incredible quotes for someone a German Chancellor to say. This might actually be the most incredible outcome of all of this situation. But, will Europe hear this self-critique and start implementing solutions?

We give it very, very low chances. Nothing stops the overregulation of the western liberal democracy. Most Europeans are fully brainwashed on rules and regulations and completely dependent on the state to provide every service and protection.

3. Donald Trump

Most interesting quote: “We probably won’t get anything unless I decide to use excessive strength and force where we would be, frankly, unstoppable. But I won’t do that.”

4. Brian Armstrong vs. François Villeroy de Galhau (Bank of France Governor)

We’re putting this as 4, but you know it’s our favorite. Brian making clear that central bankers have absolutely no idea what they are talking about and are just living in a fantasy world of the past. He had to spell it out: “Bitcoin is a decentralized protocol. There’s actually no issuer of it. So, in the sense that central banks have independence, Bitcoin is even more independent. No country, company, or individual controls it in the world.”

He reframed Bitcoin as “the greatest accountability mechanism on deficit spending.” But we already know: they won’t listen.

5. Javier Milei

“For some time now, and for some strange reason, the West began to turn its back on the ideas of liberty... However, 2026 is the year in which I bring you good news. The world has begun to awaken.” 🎉

6. Ray Dalio

Dalio warned of a “breakdown of the monetary order” asked: “Do you print money or do you let a debt crisis happen?”.

Ray is one of the few that has been sounding the alarm on fiat currencies for years if not decades, and noted central banks are shifting from dollars to gold, signalling “fiat currencies and debt as a storehold of wealth are not being held by central banks in the same way.”

God praise him.

7. Ken Griffin

The message seems to spread, and Citadel’s CEO said governments are "with little exception all spending beyond their means" and cautioned that "the longer we wait to change direction, the more draconian the consequences will be."

8. Larry Fink

“In my conversations with the leadership of these large developed countries that have xenophobic immigration policies, they don’t allow anybody to come in, [have] shrinking demographics, these countries will rapidly develop robotics and AI and technology. […] If the promise of all that transforms productivity, we’ll be able to elevate the standards of living of a country as the standards of living of individuals.”

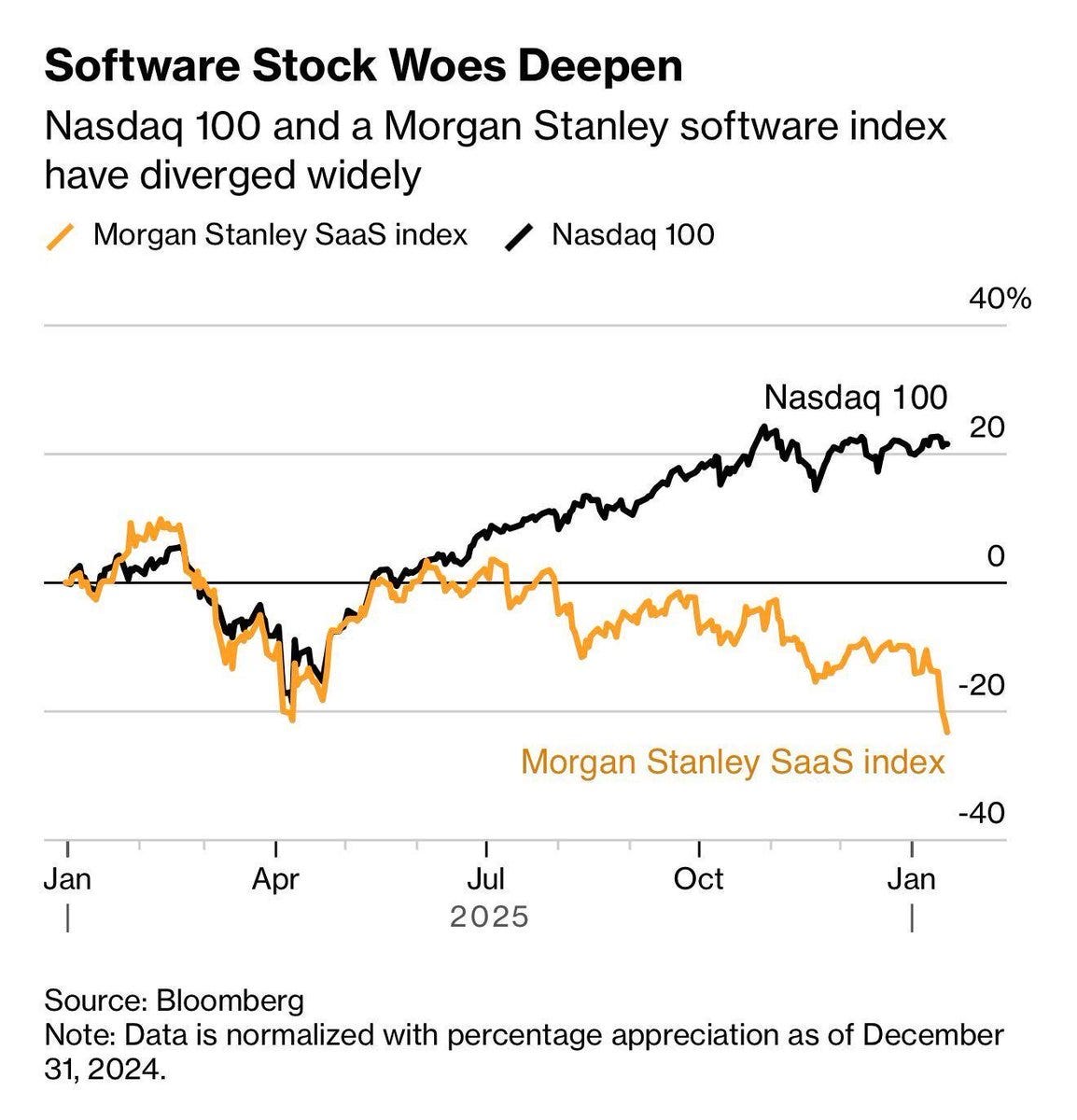

Bonus: the Great SaaS Meltdown

In 2018 I decided to stop investing in software startups. It felt like all of the good ideas had been built and the opportunities that were left didn’t feel exciting.

Funnily enough, that’s the year that GPT 1 was released.

Now, the thesis is in part vindicated, with the great SaaS meltdown in full swing.

Today, it really feels like it’s completely over for SaaS companies that aren’t AI first, and even the AI-first ones all have to answer how they will compete with the megalabs when you can spin up a product in a second with Claude Code, which then uses Claude itself.

And your competitors can create customer-specific products, bringing the margins for everyone down to ~0.

The play, which wasn’t too obvious at the time, really was to go all-in exclusively on AI megalabs, and it feels like it will be for the foreseeable future (even though we’re very happy with our early Replit investment).

The future is physical: the time for deeptech

The intuition at the time was that software was too easy and the moats just weren’t there. The times of the Salesforces, Slacks and so on felt really over.

But what wasn’t easy? Hardware. Real deep tech.

So that’s what I started investing in, and now it feels like it’s almost the time for everyone else to realize that:

AS SOFTWARE COMMODITIZES, THE REAL VALUE WILL ONLY BE ON PHYSICALLY DEPLOYED INNOVATION.

We’ve been investing like crazy in deeptech energy, techbio, biotech, industrial automation, 3d printing, medical devices, robots and will continue doing so as for the next decade that’s where the meat of the returns will be.

We expect a lot more investors to realize this over the next few years and join us in this beautiful field, where not only it’s more profitable to invest, it’s also more fun.

What to read this week

Let’s save the human species by Noah Smith: “A lot of people have managed to convince themselves that the problem of low fertility is no big deal, or that it’s easily solved, or that even viewing it as a problem is illegitimate. They are all wrong.”

From Zero to One in China: How XJTLU Is Building a New Venture Creation System: “universities are becoming engines of venture formation as well as centres of research.”

The great rug: “Once the Big Rug really kicks off, the enterprise software sector and any cloud player that hasn't hedged with their own AI research equity exposure will get completely shrekt.”

Worth watching the video of the Boston Dynamic robot walking in like he owns the building.

xAI Colossus 2 is online and is expected to have more dedicated AI power than all of Europe, while the UK argues about planning permissions and carbon commitments.

State capacity update: US companies expand protection services for top executives.

Groq’s CEO thinks AI will create labour shortages rather than a loss of jobs.

Node.js founder, one of the best programmers in the world: “the era of humans writing code is over.”

Tamarack Global’s Nuclear Renaissance Deck.

The SaaS meltdown thesis is probably the most underpriced insight here. Watching public comps in that space get crushed while everyone still pretends AI tools won't eat thier margins is wild. Ran into similar realizations a couple years ago when every pitch started looking like thin wrappers around GPT APIs. The shift to physical/deeptech makes sense but timing exits in software befor commoditization completes is gonna be brutal for most portfolios.